Articles

The fresh FDIC find if such standards is actually came across at the time out of an insured bank’s failure. Because the Paul named a couple qualified beneficiaries, their restrict insurance rates is actually $five hundred,000 ($250,100 x 2 https://passion-games.com/gala-online-casino/ beneficiaries). Because the his express from Membership step one ($350,000) is actually lower than $500,one hundred thousand, he’s totally insured. Insurance rates of combined account isn’t improved from the rearranging the fresh owners’ names or Personal Defense number, or switching the new styling of its labels. The fresh FDIC—short to the Federal Put Insurance rates Firm—try an independent service of one’s You regulators. The newest FDIC handles depositors from covered banks found in the Joined Claims against the death of their dumps, if an insured lender goes wrong.

banking basicsWhat try an atm detachment limitation?

Morgan Stanley Personal Lender now offers just about any term out of Video game that every people you need. And you may a $0 minimal deposit demands makes it a great Computer game which is available to most savers. Morgan Stanley Personal Lender features high early withdrawal charges away from 270 times of simple focus for the their three-seasons Video game and you may 450 times of simple desire to the the five-year Video game. Bank put account, such examining and you can discounts, could be susceptible to recognition.

Ruin reimbursements instead a safety deposit

You to restrict used to be much all the way down, plus it might have to go high from the near future. Come across where they’s been, in which it might be going, and exactly why it things to suit your personal cash. The information isn’t offered otherwise accredited by lender marketer. Feedback shown here are author’s by yourself, perhaps not the ones from the lending company advertiser, and have perhaps not already been reviewed, accepted otherwise endorsed from the bank marketer. Your website could be settled through the bank advertiser Associate System. It might seem you might be playing they safe or becoming brilliant, exactly what you are most doing is something entitled “structuring” and this, if the finished with intention discover inside the revealing demands, is illegal.

Bankrate symbolization

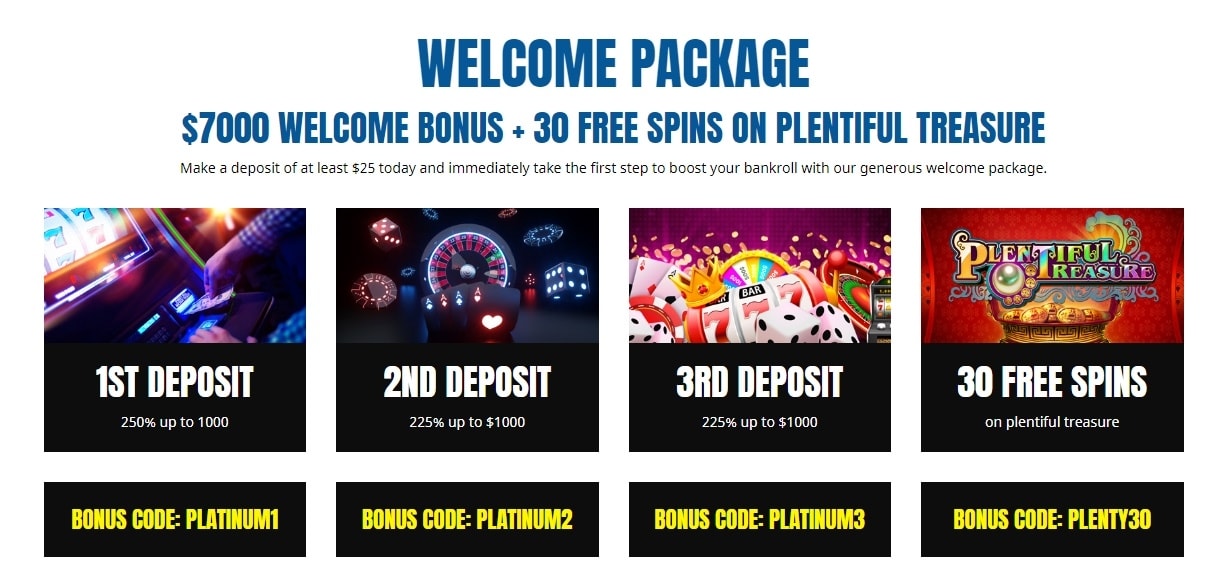

Minimumdepositcasinos.org will bring your accurate and up yet information from the best Web based casinos from around the world. Developed by a team of on-line casino pros, Lowest Deposit Casinos will discover the finest incentives and you can advertisements out of greatest gambling enterprises on the market give you the better affordability. Lower bet Roulette is actually a premier option for minimum put professionals just who nonetheless need the best playing options and you may constraints suitable for all the put philosophy.

Money field financing are common fund which can be purchased highly water short-name financial obligation, such as dollars, bucks alternatives, and you can higher-top quality, short-identity debt bonds. Money fund matches an excellent brush account otherwise a cash brush membership. Most of these software immediately give your finances across several mate banking institutions, for each and every bringing $250,000 inside FDIC publicity. You can use the fresh NCUA’s Show Insurance coverage Estimator to find out if all borrowing relationship places try safeguarded. Just remember that , additional twigs of the identical financial number as a whole establishment for FDIC aim. Beginning several accounts in the some other Pursue twigs, such as, won’t increase your coverage.

Existence Home Beneficiaries

We will send you an alerts to inform you one to your bank account is overdrawn. You are going to get the observe via mail if you have maybe not offered to discover digital interaction or you haven’t considering you having a valid email. There is no grace months in case your beneficiary away from a POD membership passes away. More often than not, insurance coverage on the dumps will be reduced instantaneously. Such, a home loan servicer collects from a single,one hundred thousand additional consumers their month-to-month mortgage repayments from $2,100000 (P&I) and you will cities the cash to your a home loan upkeep membership. The fresh $dos,100000,000 aggregate equilibrium on the mortgage servicing account is totally covered for the financial because the for each and every borrower’s fee out of $dos,100000 (P&I) are insured independently for as much as $250,100.

Personal accounts is account belonging to one person, without named beneficiaries. So, such, you’ve got a checking account and you can a bank account in the your own identity just. Combined profile provides several people but zero entitled beneficiaries.