Once they’ve deep perception, the subsequent step is to categorize those expenses for higher understanding. Moreover, these expenditures additionally assist companies in predicting upcoming expenditures. Companies can easily identify which G&A bills are adding worth with out disturbing the enterprise price range and which need to be decreased.

Each company has to pay wages to its workers, which are coated underneath G&A bills. Other than this, all the prices spent on staff are considered to be Q&A. This contains the coaching cost, insurance coverage for employees, and their business journey costs. Earlier Than you’ll have the ability to cut back spending, you need visibility into where your cash is going. As Soon As you’ve reviewed your G&A bills, take steps to handle them more intentionally.

Sales & Advertising expenses, conversely, are prices immediately associated to selling and promoting products or services. Examples include advertising prices, gross sales commissions, and salaries for the gross sales team. Promoting bills are categorized as operating expenses aimed toward revenue era.

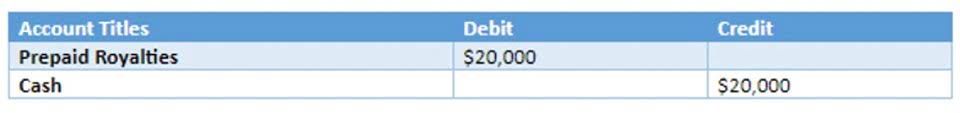

Recording G&a Bills In Your Guide

Though these expenditures have no role in generating revenue, they are essential to maintaining the business active. G&A expenses are important for understanding the company’s operational efficiency and total profitability. When the enterprise has a correct understanding of these expenses, it leads to a transparent insight into the expenditures which would possibly be needed for business operations. You can all the time search for ways to reduce back fixed prices since they haven’t any direct impression on revenue or profits. For instance, switching to a more reasonably priced insurance company can cut back your insurance prices. You can also decrease rent by altering workplaces or salaries by laying off staff.

- This contains expenses like raw supplies, direct labor, and manufacturing overhead immediately tied to the manufacturing course of.

- For example, even should you don’t sign any new accounts in November, you’ll still need to pay for rent, utilities, and continue supporting existing prospects.

- Administrative expenses don’t instantly contribute to gross sales or production so there is a sturdy incentive for management to decrease a company’s common and administrative expenses.

- Moreover, correct allocation of G&A expenses affects the money circulate statement, significantly within the operating actions part.

Hire And Utilities

In the following exhibit, we highlight the cluster of promoting, general and administrative expenses on an income assertion. First, take a tough have a glance at your administrative and basic expenses since you’ll have the ability to considerably cut back them with out disrupting or hurting production. In most circumstances, you won’t list and deduct G&A expenses from your gross margin as one line merchandise.

Payroll bills, utility payments, and worker salaries are examples of G&A. Expenditure on marketing, advertising, and different promotional materials is roofed underneath SG&A. After uncovering the proper answer about common and administrative bills, let’s see what they include. Often, professionals misunderstand G&A bills https://www.business-accounting.net/ and relate them to every expenditure.

By addressing them proactively, you’ll have the ability to keep G&A bills beneath management and defend your profitability. Not many common and administrative bills are variable so lowering administrative bills is due to this fact a troublesome proposition. This content is offered “as is,” and is not supposed to offer tax, legal or monetary advice. If you need to see the financial impression G&A expenses have on your startup’s forecast, click here to offer Finmark a attempt.

That can embody turning off equipment and lights on the finish of the day or when not in use. You can also transfer to a smaller workplace area if lease costs turn into a problem. Now, let us take a look at another way of breaking up common and administrative costs—into fixed and semi-variable expenses. When this issue goes unaddressed, it typically leads to overspending on companies general and administrative expenses and platform licenses.

Authorized And Accounting Charges

By analyzing tendencies in G&A over time and comparing them to industry benchmarks, they achieve insights right into a company’s cost management effectiveness and its capacity to scale operations effectively. Vital changes in G&A can signal strategic shifts, such as growth or cost-cutting initiatives. The level of G&A immediately impacts a company’s net revenue, making it a key think about general monetary efficiency assessment. From a budgeting perspective, distinguishing these prices allows organizations to allocate sources effectively.

For example, if a business enters into a 12-month lease settlement for workplace space at a month-to-month fee, every month-to-month fee can be thought of a fixed value recorded as G&A. By definition, mounted expenses remain consistent and can’t be decreased or eradicated via cost-reduction strategies. Classification and reporting should adhere to accounting requirements like IFRS and GAAP, which ensure consistency and comparability throughout financial statements. For example, beneath IFRS, G&A expenses are part of working bills, however businesses have some discretion in categorizing particular gadgets, provided they maintain transparency and consistency. Zombie spend refers to the unnoticed continuation of recurring prices for companies or assets no longer in use or needed for enterprise operations. These stealthy bills are like undead budget-eaters that drain firm funds with out including worth.